2020-2022’s Boom Markets

This year, a number of my clients made the long-term investment to trade into their next home for the years to come. All of my buyers opted to stay in the city and made sound purchases in highly desirable neighborhoods. Many traded smaller properties for larger and newly constructed homes. Some expressed they wanted to be closer to their children’s schools. And in turn, we also sold their former homes (also in great neighborhoods) for at or well above asking price.

ROBYN’S 2022 TRADE TRANSACTIONS

Represented the buyer

1915 Sacramento | Pacific Heights

SOLD $4,050,000

Listed and sold their former property

333 Main St #9B | The Infinity

SOLD FOR FULL PRICE $2,199,000

Represented the buyer

106 Bache | Bernal Heights

SOLD $2,500,000

Listed and sold their former property

114 Crescent | Bernal Heights

SOLD OVER ASKING $1,770,000

Represented the buyer

425 24th Ave | Richmond District

SOLD $2,425,000

Listed and sold their former property

80 Alvarado | Noe Valley

SOLD OVER ASKING $1,375,000

There are two types of booming markets that emerged during the pandemic years that contributed to the overheated conditions from 2020-2022. They are different. Let’s explore both:

- The Longterm Boom Markets

COVID also triggered something that had been missing in the markets: the urgency to accelerate plans that had been mulled over but not acted on for some time: retirement, a move to the suburbs, a move to a city, or smaller city, a move for political reasons, a move for lower state taxation, a move to a warmer or cooler climate, etc. These moves, while accelerated, causing exaggerated home price spikes, are less susceptible to big price declines. I’d suspect this arena re-balances, with more steady appreciation over the longterm and it’s possible these areas may continue to see price gains, mostly fueled by under-supply, but equally by continued, growing demand.

- The Transitory Boom Markets

When COVID hit hard, many people re-evaluated – often hastily – where and how they wanted to live. Some of these people were highly reactionary expecting the very worst and an extended global meltdown. Many immediately surmised that viral infection and death rates would be far higher in urban centers where the concentration of people was higher. This theory proved to be inaccurate. These people made purchases in rural counties in the state or moved to smaller towns in different states, and are now re-visiting where they wish to live yet again. Some markets that experienced this insurgence of a new audience saw prices surging at levels few thought sustainable. Some of these areas will erode some or most of these gains of the past 2 years.

It appears that after the big drop in post pandemic demand, conditions have mostly stabilized. When looking at recent market changes, it is important to remember how overheated the market was in 2021 and early 2022 – quarter-to-quarter and year-over-year comparisons were distorted by the unusual pandemic boom market conditions that prevailed then. It is also wise not to jump to definitive conclusions based upon a single quarter’s data. The economy and real estate market are still in a period of adjustment.

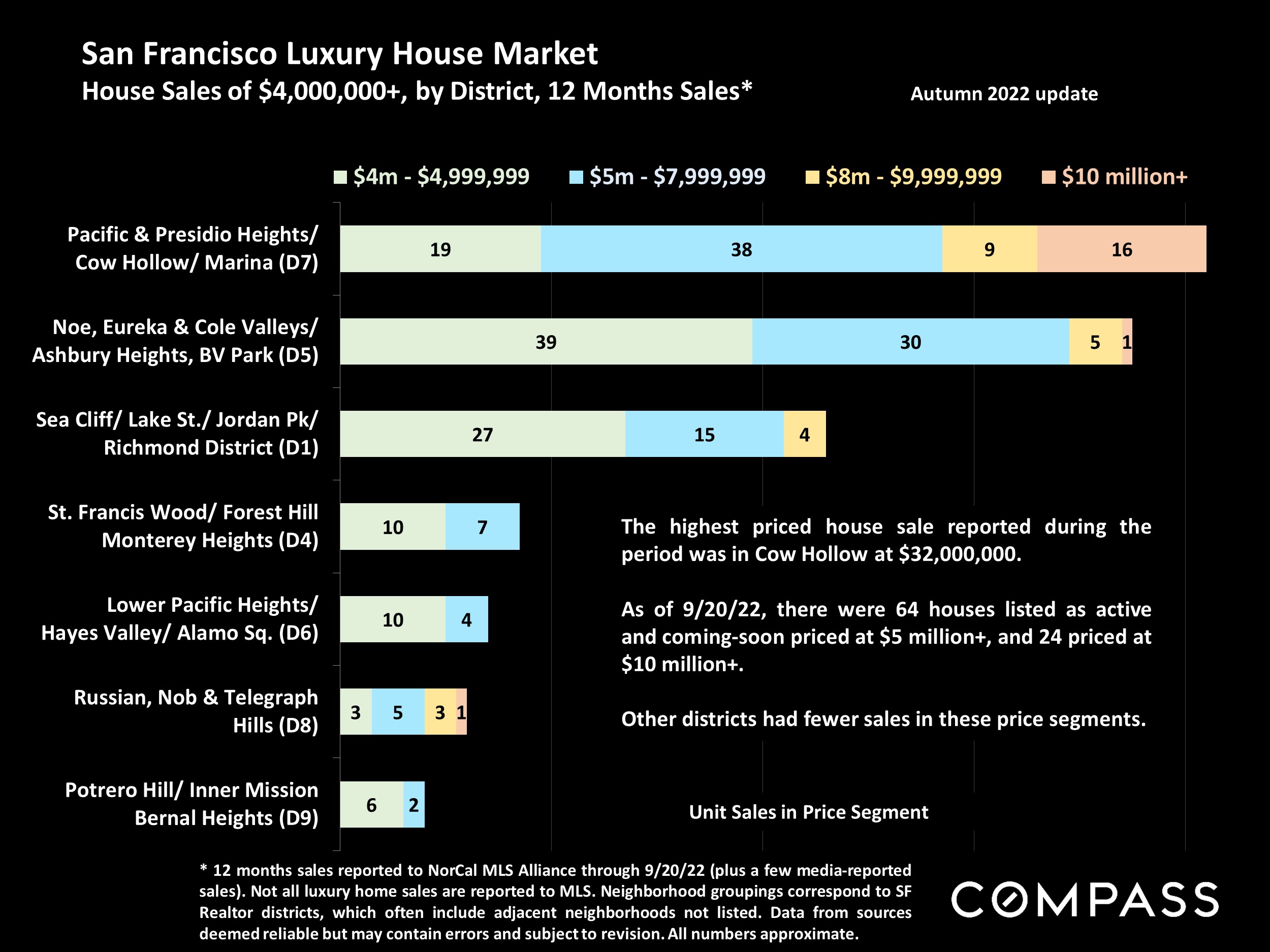

San Francisco Luxury House Sales in 2022

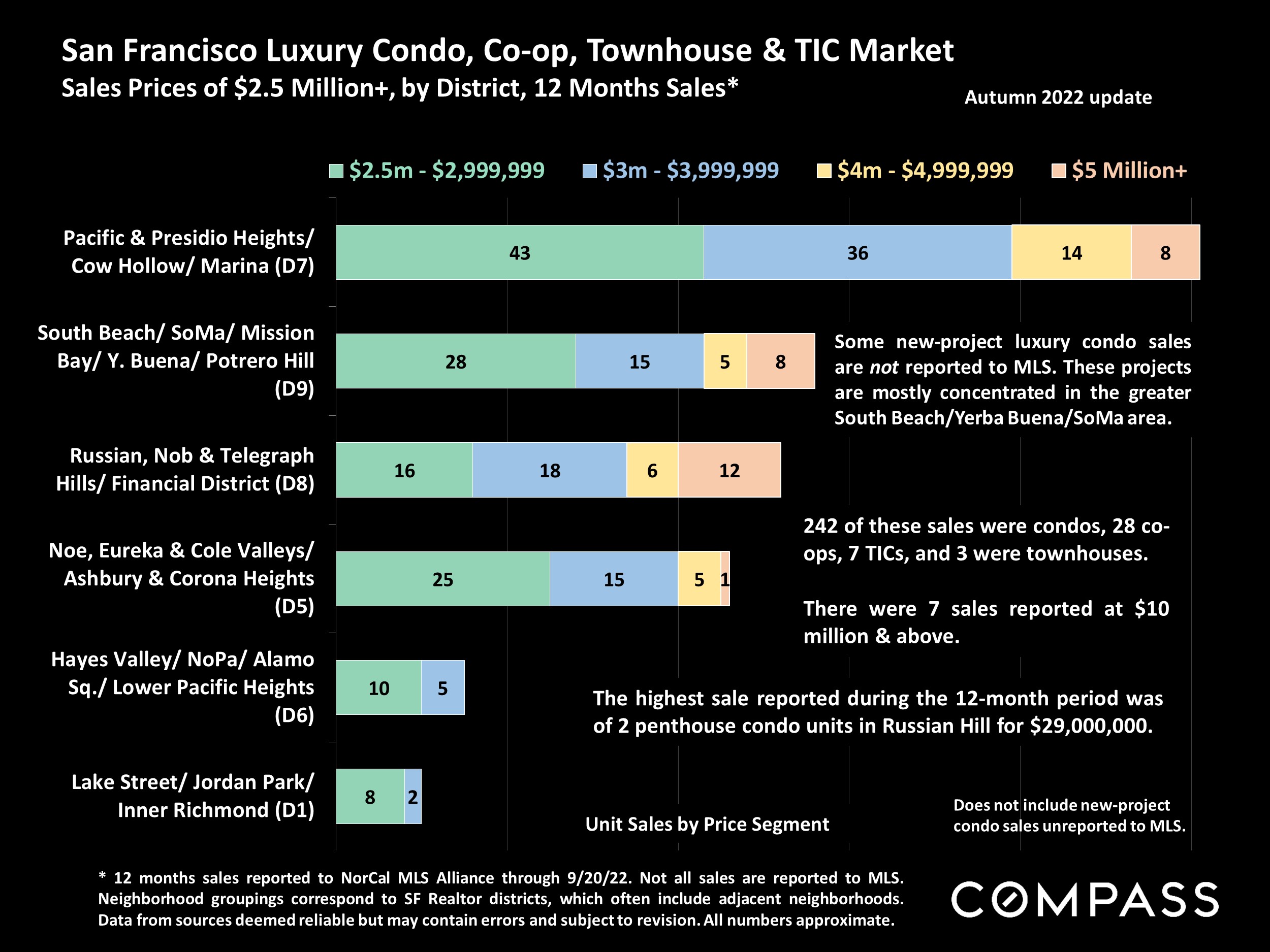

San Francisco Luxury Condo Sales in 2022