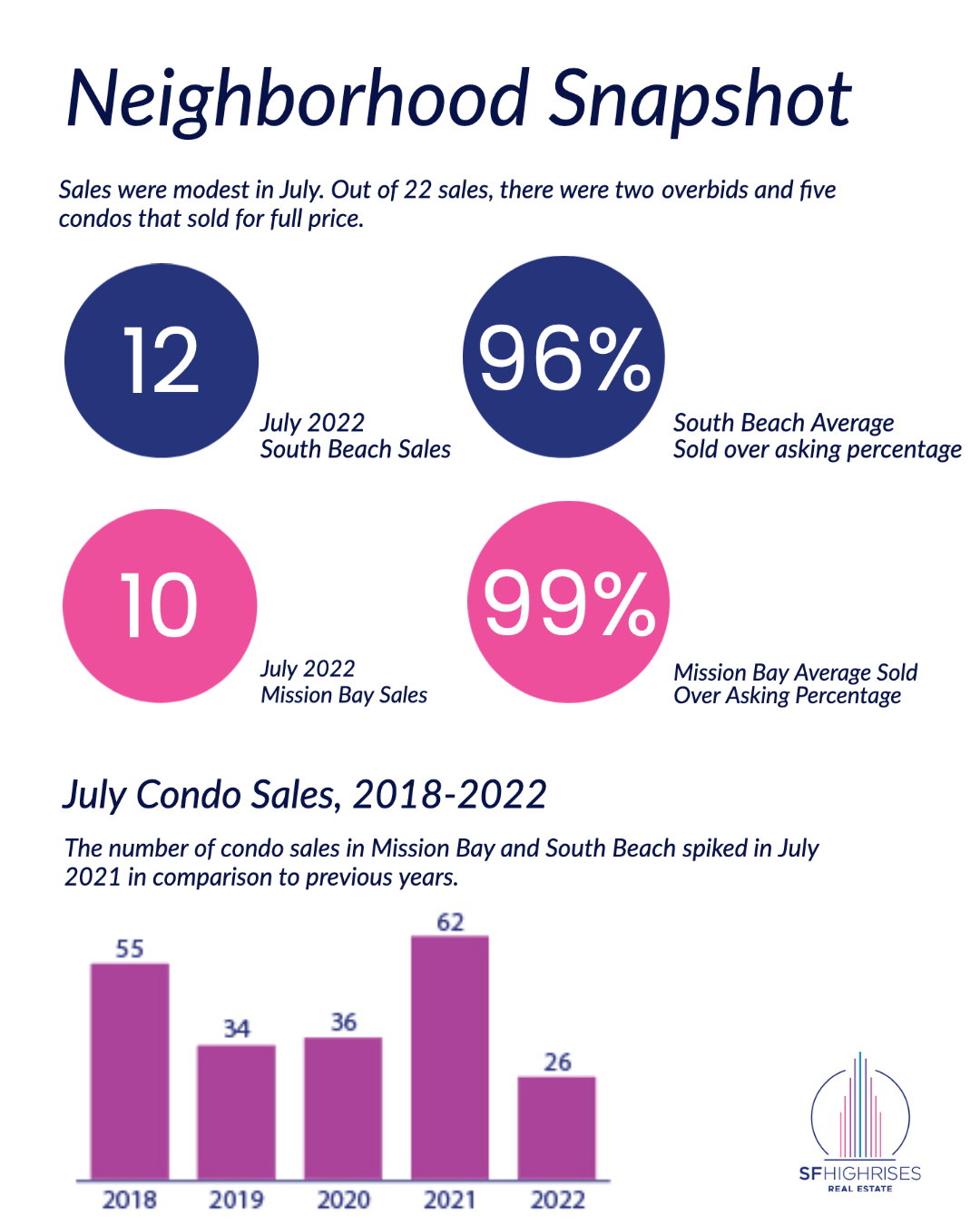

South Beach and Mission Bay condo sales were modest in July due to the seasonal summer slowdown and the rise in interest rates. It’s clear and evident that an increase in mortgage rates is impacting sales citywide and nationwide because it’s gotten more expensive to buy a home. The cost to borrow money also is higher with The Federal Reserve increasing the Fed Funds Rate by .75%, as expected. All of this and more in the news cycle are currently affecting your condo’s worth in South Beach and Mission Bay, BUT if the Federal Reserve’s plan works in terms of curbing inflation, a healthy, more balanced market could materialize.

According to this New York Times article (toggle to Reader View on your browser), the rate increase affects these credit lines that many consumers are accustomed to using:

- Credit cards

- Car loans

- Student Loans

*As for homeowners, it impacts:

- HELOCs

- Adjustable-rate mortgages

* Home equity lines of credit and adjustable-rate mortgages — which each carry variable interest rates — generally rise within two billing cycles after a change in the Fed’s rates.

But according to MMG weekly, a report that loan advisors often refer to, the Fed Funds rate hike does not necessarily impact mortgage rates negatively. As The Fed raised rates by 1.50% in the last 45 days, the 10-yr Note yield has declined from 3.49% to 2.75% in the same time frame. Why? Fed rate hikes slow economic growth, cool inflation, and unemployment ticks up. But long-term rates do move lower.

“Fed’s ONLY tool to fight inflation is raising rates… But raising rates does not combat inflation across all sectors evenly; It just dilutes the purchasing power of individuals, because demand goes down and this reduces the upward pressure on price. Prices come down.” Risha Kilaru, Origin Point Mortgage

After it’s all said and done, consumer confidence generally is low because everyday items have become more expensive to purchase. And homes especially are more expensive to purchase – if mortgage rates are high and appreciation is high, there obviously will be less buyers. The situation is always changing. If the Fed’s job to curb inflation works as interest rates come down from their peaks, that would be positive news for property values in South Beach and Mission Bay. Stay tuned and be sure to contact me for ANYTHING you might need.

The Silver Lining

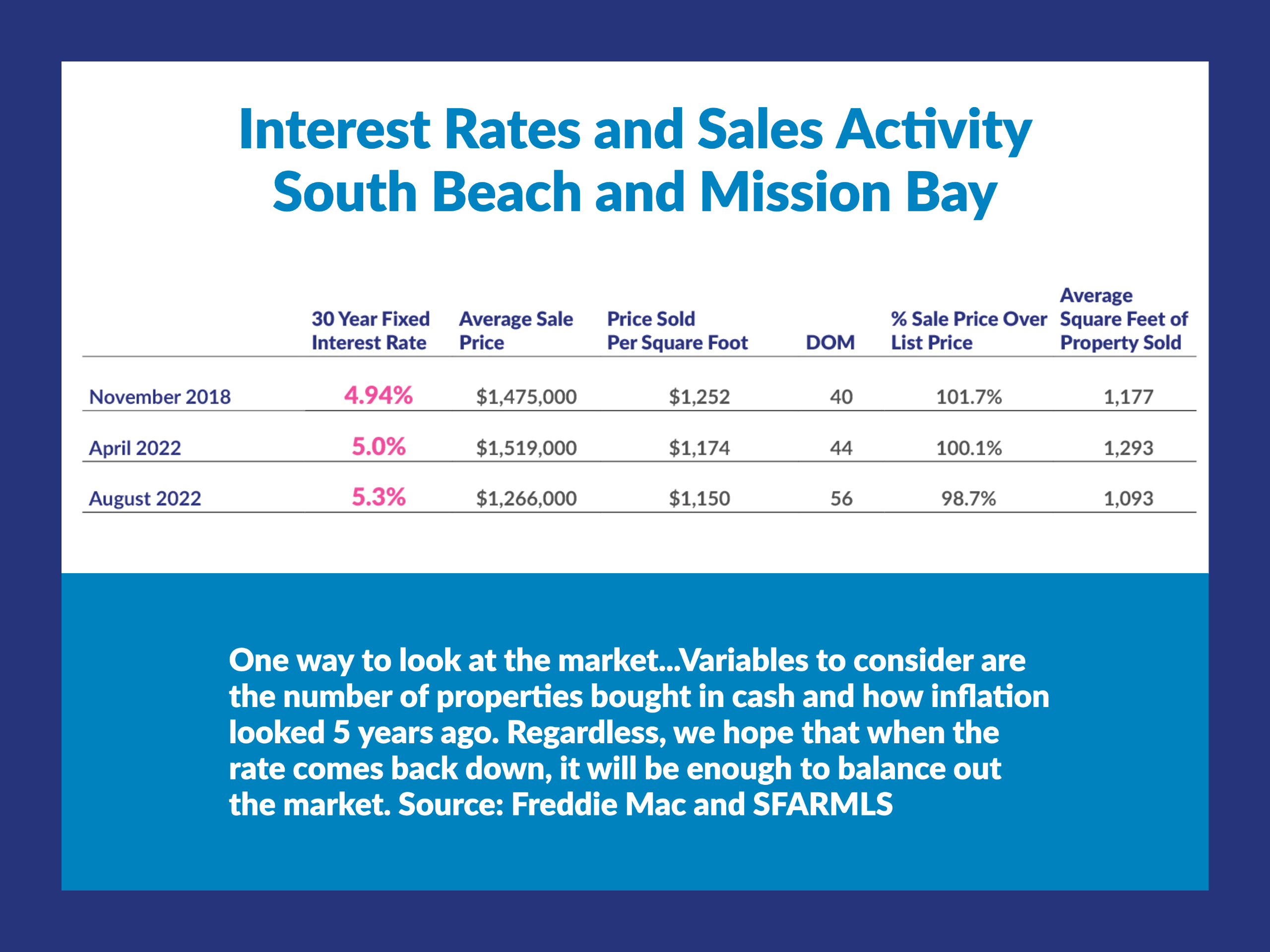

When you look at the mortgage rate chart found on Freddie Mac, all rates peaked in June 2022 and is down .5% now. For example, the 30-year fixed in the week ending June 23rd was 5.81%. Currently it’s 5.3%. According to MMG, it appears that June will represent the rate peaks for 2022. To read all about it, visit this link, scroll down to the “Mortgage Market Guide Candlestick Chart” to understand how home loan rates are determined.

The Magic Numbers For Your Condo’s Worth In South Beach and Mission Bay

Putting the story all together! While we were brainstorming this blog post, we wanted to visually demonstrate how the interest rate has impacted property values in South Beach and Mission Bay.

If you want to talk real estate, buying opportunities, new condo investments, feel free to contact me anytime. I’m always here to help you answer questions about your condo’s worth in the neighborhood.